Presented below are income statements prepared on an average-cost and FIFO basis for Carlton SA, which started operations on January 1, 2021. The company presently uses the average-cost method of pricing its inventory and has decided to switch to the FIFO method in 2022. The FIFO income statement is computed in accordance with IFRS.

How to Use the FIFO Periodic Inventory Method to Improve Restaurant Management

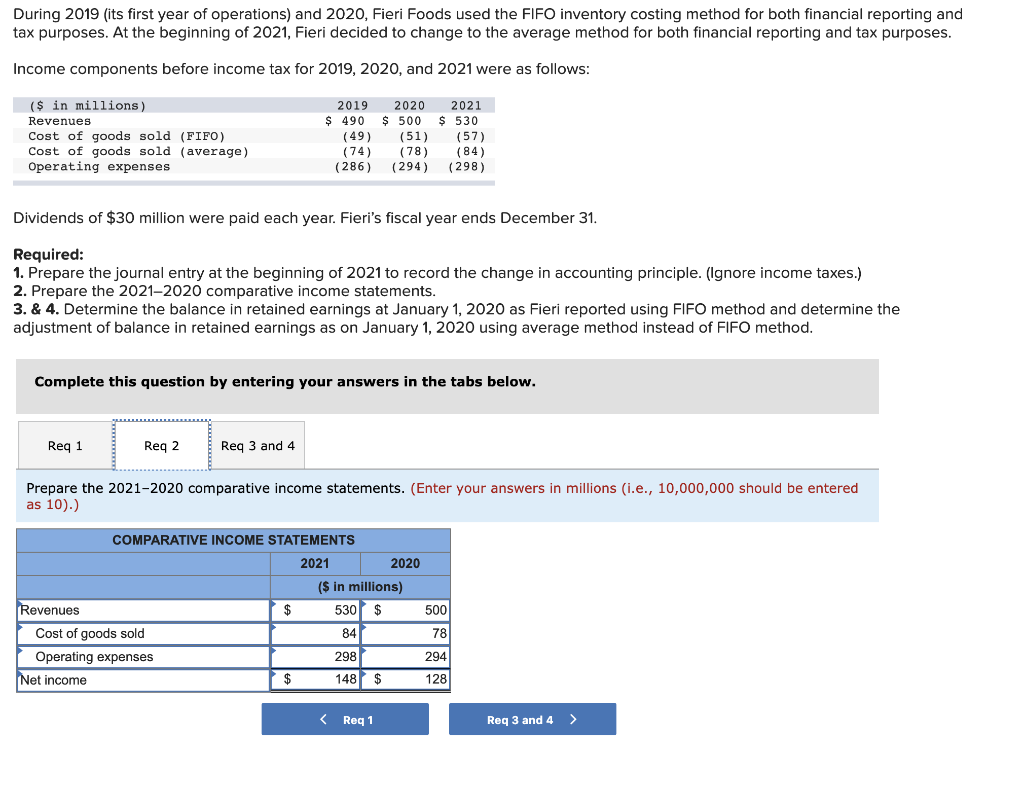

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2021, Fieri decided to change to the average method for both financial reporting and tax purposes. Income components before income tax for 2019, 2020, and 2021 were as follows:

Source Image: accountinginfocus.com

Download Image

Taveras Co. decides at the beginning of 2014 to adopt the FIFO method of inventory valuation. Taveras had used the LIFO method for financial reporting since its inception on January 1, 2012, and had m; During 2015, Crop-Paper-Scissors, a craft store, changed to the LIFO inventory costing method of accounting for inventory.

Source Image: staffany.com

Download Image

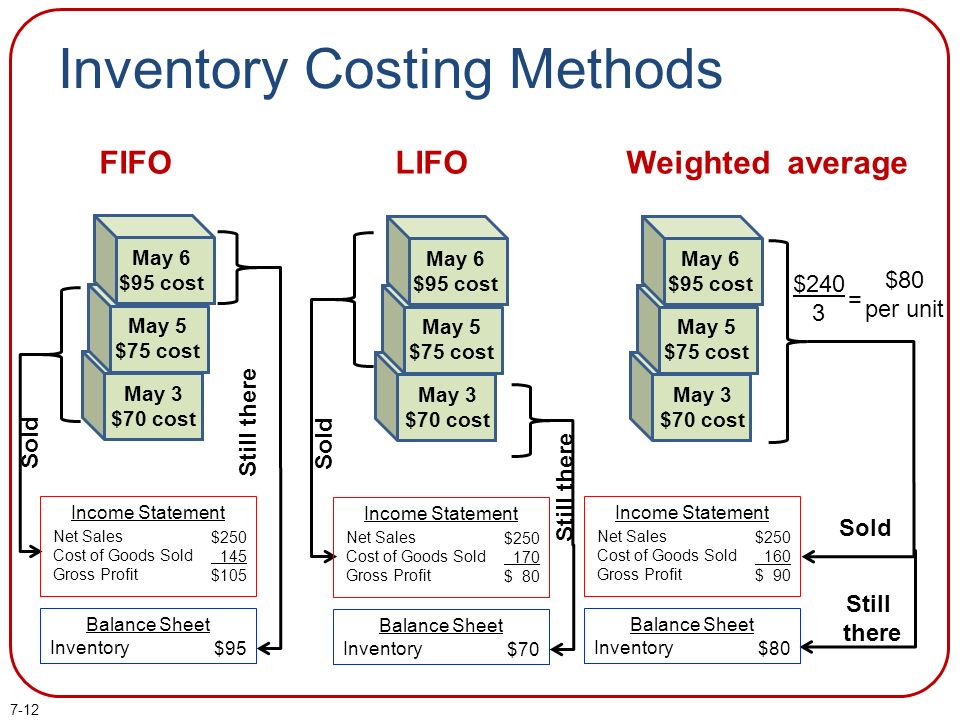

Inventory and Cost of Goods Sold – ppt download

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting a ax purposes.

Source Image: eswap.global

Download Image

Fieri Foods Used The Fifo Inventory Costing Method

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting a ax purposes.

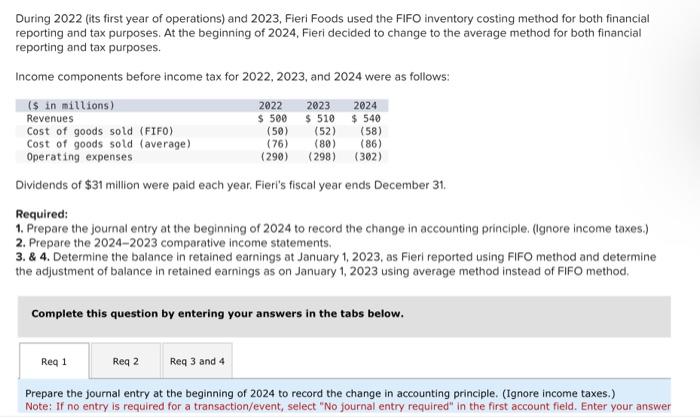

During 2022 (its first year of operations) and 2023, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Fieri decided to change to the average method for both financial reporting and tax purposes.

Inventory Valuation Methods: FIFO & LIFO (With Examples) – eSwap

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2021, Fieri decided to change to the average method for both financial reporting and tax purposes. Income components before income tax for 2019, 2020, and 2021 were as follows:

Solved During 2019 (its first year of operations) and 2020, | Chegg.com

Source Image: chegg.com

Download Image

FIFO Inventory Management Method: Understanding the Basics and Benefits

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2021, Fieri decided to change to the average method for both financial reporting and tax purposes. Income components before income tax for 2019, 2020, and 2021 were as follows:

Source Image: linkedin.com

Download Image

How to Use the FIFO Periodic Inventory Method to Improve Restaurant Management

Taveras Co. decides at the beginning of 2014 to adopt the FIFO method of inventory valuation. Taveras had used the LIFO method for financial reporting since its inception on January 1, 2012, and had m; During 2015, Crop-Paper-Scissors, a craft store, changed to the LIFO inventory costing method of accounting for inventory.

Source Image: xenia.team

Download Image

Inventory and Cost of Goods Sold – ppt download

Presented below are income statements prepared on an average-cost and FIFO basis for Carlton SA, which started operations on January 1, 2021. The company presently uses the average-cost method of pricing its inventory and has decided to switch to the FIFO method in 2022. The FIFO income statement is computed in accordance with IFRS.

Source Image: slideplayer.com

Download Image

Controlling Food Costs in Storage and Issuing – ppt video online download

Business Accounting Accounting questions and answers During 2022 (its first year of operations) and 2023, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Fieri decided to change to the average method for both financial reporting and tax purposes.

Source Image: slideplayer.com

Download Image

Inventory Costing Methods specific unit cost, FIFO, LIFO, average cost – Professor Victoria Chiu – YouTube

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting a ax purposes.

Source Image: m.youtube.com

Download Image

Solved During 2022 (its first year of operations) and 2023. | Chegg.com

During 2022 (its first year of operations) and 2023, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Fieri decided to change to the average method for both financial reporting and tax purposes.

Source Image: chegg.com

Download Image

FIFO Inventory Management Method: Understanding the Basics and Benefits

Solved During 2022 (its first year of operations) and 2023. | Chegg.com

During 2019 (its first year of operations) and 2020, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2021, Fieri decided to change to the average method for both financial reporting and tax purposes. Income components before income tax for 2019, 2020, and 2021 were as follows:

Inventory and Cost of Goods Sold – ppt download Inventory Costing Methods specific unit cost, FIFO, LIFO, average cost – Professor Victoria Chiu – YouTube

Business Accounting Accounting questions and answers During 2022 (its first year of operations) and 2023, Fieri Foods used the FIFO inventory costing method for both financial reporting and tax purposes. At the beginning of 2024, Fieri decided to change to the average method for both financial reporting and tax purposes.