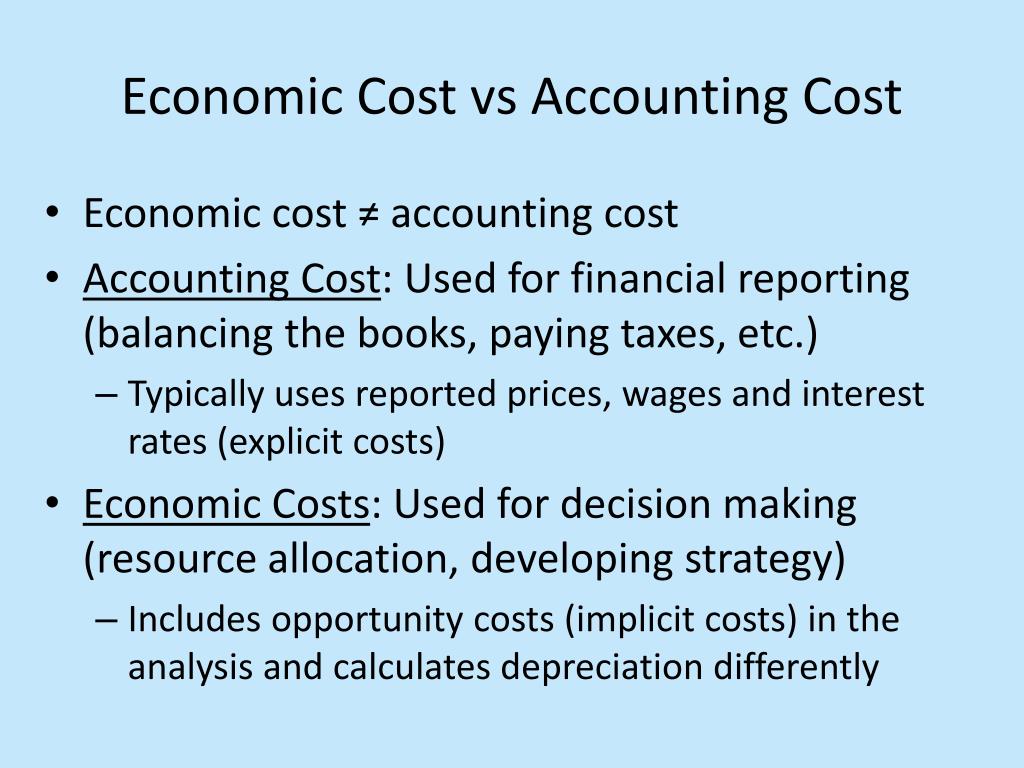

Economic costs include the same explicit costs that accounting costs use in calculations, but economic costs also include implicit costs. Implicit costs are those values that

12 Best Accounting Software for SMEs in Singapore 2024

It means total revenue minus explicit costs—the difference between dollars brought in and dollars paid out. Economic profit is total revenue minus total cost, including both explicit and implicit costs. The difference is important because even though a business pays income taxes based on its accounting profit, whether or not it is

Source Image: slideserve.com

Download Image

Mar 9, 2023Updated 9 March 2023 Business owners regularly handle both implicit and explicit costs of running a business. The terms accounting costs and economic costs describe a company’s actual and potential expenses within an accounting period. Knowing the difference between these costs can enable you to determine a business’s profitability and health.

Source Image: datatrained.com

Download Image

Economic and accounting cost, explicit and implicit cost, opportunity cost – YouTube Apr 13, 2023As such, accounting profit represents a company’s true profitability while economic profit is indicative of its efficiency. Companies are only required to report one form of profit to the Internal

Source Image: pt.slideshare.net

Download Image

Economic Costs And Accounting Costs Differ Because Accountants Include

Apr 13, 2023As such, accounting profit represents a company’s true profitability while economic profit is indicative of its efficiency. Companies are only required to report one form of profit to the Internal Step 1. First we’ll calculate the costs. We’ll use what we know about explicit costs: Explicit costs = Office rental − Law clerk’s salary Explicit costs = $ 50, 000 + $ 35, 000 Explicit costs = $ 85, 000. Step 2. Subtracting the explicit costs from the revenue gives you the accounting profit.

Cost concepts and behaviours | PPT

Economic costs and accounting costs differ because economists include Both explicit and implicit costs Short run the period of time during which at least one of a firm’s inputs is fixed long run the time period in which all inputs can be varied marginal product Difference between Explicit Cost and Implicit Cost – Tutor’s Tips

Source Image: tutorstips.com

Download Image

Definition of Accrued Liabilities: Guide for Small Businesses – Shopify Malaysia Economic costs and accounting costs differ because economists include Both explicit and implicit costs Short run the period of time during which at least one of a firm’s inputs is fixed long run the time period in which all inputs can be varied marginal product

Source Image: shopify.com

Download Image

12 Best Accounting Software for SMEs in Singapore 2024 Economic costs include the same explicit costs that accounting costs use in calculations, but economic costs also include implicit costs. Implicit costs are those values that

Source Image: hashmicro.com

Download Image

Economic and accounting cost, explicit and implicit cost, opportunity cost – YouTube Mar 9, 2023Updated 9 March 2023 Business owners regularly handle both implicit and explicit costs of running a business. The terms accounting costs and economic costs describe a company’s actual and potential expenses within an accounting period. Knowing the difference between these costs can enable you to determine a business’s profitability and health.

Source Image: m.youtube.com

Download Image

Economic vs. Accounting Cost | Definition, Formula & Examples – Video & Lesson Transcript | Study.com The total of the accounting costs, plus the differences in costs between choosing the other options instead of option A, is the economic cost. Economic costs include both the explicit and implicit costs of an action. Another example is if a company has an asset — an orange grove, for example — and uses an economic cost analysis to determine

Source Image: study.com

Download Image

Cost Accounting Principles (Speedy Study Guides) (Paperback) – Walmart.com | Cost accounting, Accounting principles, Study guide Apr 13, 2023As such, accounting profit represents a company’s true profitability while economic profit is indicative of its efficiency. Companies are only required to report one form of profit to the Internal

Source Image: pinterest.com

Download Image

Chapter 1 Part 2: Differences between Economic v. Accounting Cost & Economics v. Accounting Profits! – YouTube Step 1. First we’ll calculate the costs. We’ll use what we know about explicit costs: Explicit costs = Office rental − Law clerk’s salary Explicit costs = $ 50, 000 + $ 35, 000 Explicit costs = $ 85, 000. Step 2. Subtracting the explicit costs from the revenue gives you the accounting profit.

Source Image: m.youtube.com

Download Image

Definition of Accrued Liabilities: Guide for Small Businesses – Shopify Malaysia

Chapter 1 Part 2: Differences between Economic v. Accounting Cost & Economics v. Accounting Profits! – YouTube It means total revenue minus explicit costs—the difference between dollars brought in and dollars paid out. Economic profit is total revenue minus total cost, including both explicit and implicit costs. The difference is important because even though a business pays income taxes based on its accounting profit, whether or not it is

Economic and accounting cost, explicit and implicit cost, opportunity cost – YouTube Cost Accounting Principles (Speedy Study Guides) (Paperback) – Walmart.com | Cost accounting, Accounting principles, Study guide The total of the accounting costs, plus the differences in costs between choosing the other options instead of option A, is the economic cost. Economic costs include both the explicit and implicit costs of an action. Another example is if a company has an asset — an orange grove, for example — and uses an economic cost analysis to determine